Why Do You Need Title Insurance?

Protection For Your Home

Your home is the single most important and costly asset you will probably ever own. Problems with the title to your property can limit your use and enjoyment of real estate, as well as bring financial loss.

Protection against hazards of title is available through a unique coverage known as title insurance. Unlike other kinds of insurance that focus on possible future events and charge an annual premium, title insurance is a one time payment and is a safeguard against loss arising from flaws and defects already existing in the title.

Protection against hazards of title is available through a unique coverage known as title insurance. Unlike other kinds of insurance that focus on possible future events and charge an annual premium, title insurance is a one time payment and is a safeguard against loss arising from flaws and defects already existing in the title.

Lenders Require A Policy: You Should Too!

Your mortgage lender also has a great financial interest in the property you’re buying. Just as you do, lenders rely on the Title Insurance Policy to ensure that they won’t be impacted by unforeseen title problems that could affect them. The Lender’s Policy covers them for the amount of the loan, but decreases and eventually disappears as the loan is paid off.

However, this policy does not protect your interest as a homeowner. You need to purchase a separate Owner’s Title Insurance Policy, so don’t forget to request one! The Owner’s Title Insurance Policy is ordinarily issued in the amount of the purchase price and lasts as long as you – or your heirs – have an interest in the property concerned.

However, this policy does not protect your interest as a homeowner. You need to purchase a separate Owner’s Title Insurance Policy, so don’t forget to request one! The Owner’s Title Insurance Policy is ordinarily issued in the amount of the purchase price and lasts as long as you – or your heirs – have an interest in the property concerned.

Risk Elimination

Title insuring begins with a search of the public land records for matters affecting the title to real estate concerned.

The search process provides warnings of title flaws that must be dealt with before the property can change hands. Here are some examples of typical flaws:

• Deeds, wills and trust that contain improper vesting and incorrect names

• Outstanding mortgages, judgments and tax liens

• Easements • Incorrect Notary acknowledgements.

Once title professionals find these title issues, they then work to remedy any problems that could keep your from having “clear” title.

• Deeds, wills and trust that contain improper vesting and incorrect names

• Outstanding mortgages, judgments and tax liens

• Easements • Incorrect Notary acknowledgements.

Once title professionals find these title issues, they then work to remedy any problems that could keep your from having “clear” title.

Hidden Title Defects

The best title search, performed by the most experienced and capable experts, cannot ensure that no title defect exist.

Some of the problems just aren’t revealed in the public records. Your Owner’s title Insurance Policy protects your interest in the property against such unforeseen hazards as:

• Mistakes in recording of legal documents

• Forged deeds, releases or wills

• Undisclosed or missing heirs, including spouses

• Deeds by minors

• Deed executed under invalid or expired power of attorney

• Liens for unpaid taxes

• Fraud

• Mistakes in recording of legal documents

• Forged deeds, releases or wills

• Undisclosed or missing heirs, including spouses

• Deeds by minors

• Deed executed under invalid or expired power of attorney

• Liens for unpaid taxes

• Fraud

The Ins And Outs Of Title Insurance

Who Is Covered By Title Insurance?

The Lender: Title Insurance covers the outstanding balance on the mortgage for the lender.

The Buyer: When acquiring a property, it’s a good idea to have insurance, since it will give you protection in case there’s a title claim against your home.

The Buyer: When acquiring a property, it’s a good idea to have insurance, since it will give you protection in case there’s a title claim against your home.

What Is Title Insurance?

Title Insurance is a contract to protect an owner against losses arising through defects in the title to real estate owned. If a title is insurable, the company guarantees the owner against a loss due to any defect in title or expenses in a legal defense of the title, pursuant to the terms of the policy. The process of examining all relevant records to confirm that the seller is the legal owner of a property and that there are no liens or other claims outstanding.

When Is A Title Defective?

There are many possible causes of title defects that no examination can disclose. That is because they have never been recorded and thus do not appear in the abstract. A title insurance policy protects the owner against all these hidden risks; those listed below and many more:

Fraud: False claims of ownership, forged deeds, wills, signatures, conveyances, instruments, false representations, attorneys, destruction of records.

Improper Deeds and Wills: Deeds by persons of unsound mind, minors, deeds delivered after death or without the grantor’s consent; invalid, suppressed erroneous wills, missing heirs, unsettled estates.

Liens and Other Rights: Liens for unpaid estate, income and property taxes, mechanic’s liens, unpaid mortgages, irregular court proceedings, defective foreclosures, sewer and water assessments.

Fraud: False claims of ownership, forged deeds, wills, signatures, conveyances, instruments, false representations, attorneys, destruction of records.

Improper Deeds and Wills: Deeds by persons of unsound mind, minors, deeds delivered after death or without the grantor’s consent; invalid, suppressed erroneous wills, missing heirs, unsettled estates.

Liens and Other Rights: Liens for unpaid estate, income and property taxes, mechanic’s liens, unpaid mortgages, irregular court proceedings, defective foreclosures, sewer and water assessments.

Where Do I Get Title Insurance?

Contact 1st Equity Title & Closing Services to quickly, efficiently and accurately process your commitment and policy.

Why Is Title Insurance Important?

It provides you with protection of your property, and it can save you money, time, and trouble with your home. When a person buys a car or consumer goods, they seldom need to know whether the former owner is married, single, or divorced, whether they have paid their taxes or are involved in a lawsuit. But when a person buy a home, it is necessary to have all the information and much more. While he or she may own the property, others may also have rights or prior claims in the same real estate.

How Much Does Title Insurance Cost?

The one-time premium is directly related to the value of your home. It is a one-time expense, paid when you purchase your home, yet it continues to provide complete coverage for as long as you or your heirs own the property.

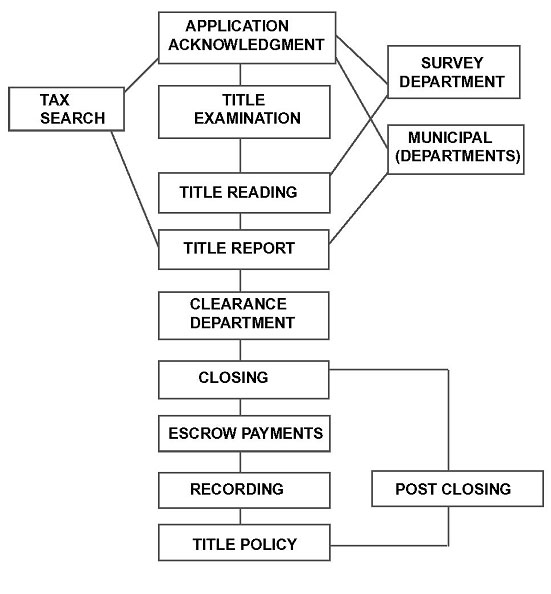

Title Insurance Flow Chart

Title Insurance Flow Chart, 1st Equity Title & Closing Services